Inequality in Equalland

Life in the nation of Equalland (population 80 million) is idyllic. Boring, but idyllic. By all measures, it is a wonderful place to live: Zero infant mortality; 100% high school graduation; 100% college graduation; zero unemployment; zero income inequality; a steadily rising stock market; no poverty; etc. There is one measure which raises some eyebrows, however: The wealthiest 20% of households own well over 50% of the nation's wealth.Every resident of Equalland has the same life story. From birth until age 18, they live with their parents, earning nothing and spending nothing — their parents cover all their needs. At age 18, they graduate from high school, become independent of their parents, and go to college. The government of Equalland funds the post-secondary system well enough that it can provide free tuition to students, but the college students of Equalland want to study full-time, so they take out student loans to cover their living expenses. At age 22 they graduate from college, get married, and have children (in Equalland, women always give birth to pairs of twins, one male and one female, in order to keep the gender ratio fixed at 1:1). They immediately find jobs, and work until age 65, all earning the same constant (inflation-indexed) salary, gradually saving up enough money (which they invest in the stock market) to pay for their retirement. At age 65 they retire, and they gradually spend their retirement savings until age 80, when they die peacefully in their sleep and their few dollars of remaining retirement savings are spent on funeral costs.

To provide a more concrete picture of the household economics of Equalland, here's some more numbers (dollar values are inflation-adjusted, i.e., expressed in constant "2011 dollars"):

- The stock market rises at a consistent rate of inflation + 4% each year.

- Student loans carry with them an interest rate equal to the stock market's growth rate (since both are zero-risk investments, there is no reason for them to have different rates).

- While at college, each student spends $15,000 per year.

- From age 22 until 65, every person earns $50,000 per year (while on parental leave or when sick, enlightened government policies replace 100% of their income).

- Every 4-person household (parents aged between 22 and 40) spends $90,000 per year, thus saving $10,000 per year towards retirement.

- After their kids leave home, household expenses drop by $10,000 per year (kids are expensive!), and thus parents start saving $20,000 per year towards their retirement.

- Upon retiring, their expenses drop slightly further, to $75,000 per year, due to a lack of employment-related costs (e.g., bus/train fares).

- Upon dying when they (simultaneously) reach age 80, each couple has $5,452 remaining, which covers their funeral costs.

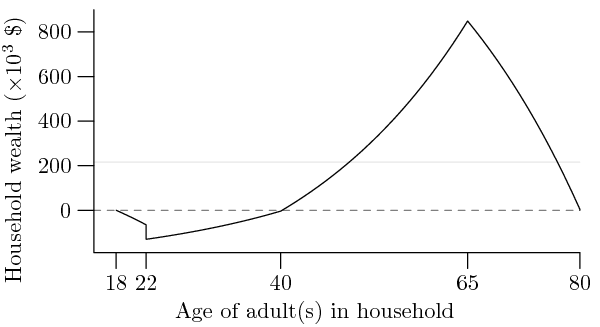

From these numbers, we can obtain a complete picture of the wealth of Equalland:

The most indebted households in Equalland — $130,133 in debt, to be precise — are those formed by 22 year olds; not only have they spent 4 years taking student loans while studying at college, but they have also just married, thus doubling their per-household debt. The average household, in contrast, has a comfortable $206,080 in retirement savings.

But what of the wealthiest? Out of the 33 million households in Equalland, the wealthiest 20% — 6.6 million households — are aged between 58 years 5 months and 71 years 8 months: In short, those who are either about to retire or recently retired. Their average wealth is $693,182 — over triple the average wealth — and between them, they hold 4.58 trillion dollars out of Equalland's total 7.13 trillion dollars of household wealth... or slightly over 64%. So much for equality.

Obviously no such country exists, and most countries have significantly higher wealth inequality — in the US, for example, the top 20% of households own 84% of the wealth. But consider this: Equalland is an idealized scenario. If the stock market didn't rise consistently, or some people lived beyond age 80, or some people had significant medical costs in their final years — or, god forbid, there was any variability in how much individuals earned — then the top 20% of the population would need to hold more than 64% of the country's wealth just to maintain their standard of living after retiring.

Is there too much inequality in the world? Sure. Is all inequality bad? Not if you hope to retire some day.